Plotting The Fed's Baby Step 1/8 Point Hikes

Mike (Mish) Shedlock | Aug 19, 2015 05:53AM ET

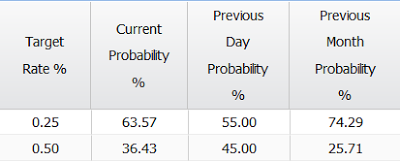

The market still believes the Fed will hike rates in September or October. The CME's FedWatch Sees it like this.

That table is based on Fed Fund Futures and option bets. I highly doubt the Fed will think about a half-point hike no matter how strong the economic data between now and the September 16-17 meeting.

Fed Funds Futures expire on the last day of the month but settle at the average rate for 30 days prior.

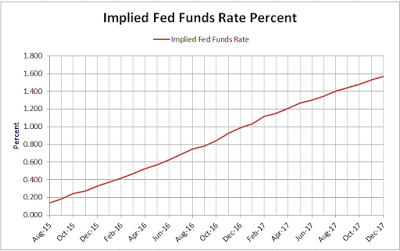

Using Fed Funds Futures (not options) from August 18, I generated the chart and table below.

Implied Fed Funds Rate 2015-08-18

Comments

- Rate hikes will not be that smooth. For starters, meetings are 8 times a year, not 12.

- The current Fed Funds Rate as of August 18, 2015 is .0138 percent.

- The implied rate for September is only 0.185 percent (but that is a 30-day average).

- The implied rate does not hit .025 percent until October. That would roughly be a 1/8 point hike from the current rate of 0.138 percent.

- The next 1/8 point hike would not occur until December or January at the earliest.

Let's assume the Fed actually does get a hike off in September if for no other reason than the market expects such a hike.

Based on Fed Fund Futures and FOMC Meeting Dates , and taking into account 30-day averages, the table of future rate hikes looks something like this.

Rate Hike Dates and Amounts

| Month | Fed Funds Future | Implied Fed Funds Rate | Meeting Date | Market Expectation |

|---|---|---|---|---|

| Aug-15 | 99.863 | 0.138 | ||

| Sep-15 | 99.815 | 0.185 | 16-17 | 0.250 |

| Oct-15 | 99.755 | 0.245 | 27-28 | |

| Nov-15 | 99.730 | 0.270 | ||

| Dec-15 | 99.675 | 0.325 | 15-16 | 0.375 |

| Jan-16 | 99.625 | 0.375 | 26-27 | |

| Feb-16 | 99.585 | 0.415 | ||

| Mar-16 | 99.535 | 0.465 | 15-16 | 0.500 |

| Apr-16 | 99.475 | 0.525 | 26-27 | |

| May-16 | 99.430 | 0.570 | ||

| Jun-16 | 99.375 | 0.625 | 14-15 | 0.625 |

| Jul-16 | 99.315 | 0.685 | 26-17 | |

| Aug-16 | 99.255 | 0.745 | ||

| Sep-16 | 99.220 | 0.780 | 20-21 | 0.750 |

| Oct-16 | 99.155 | 0.845 | ||

| Nov-16 | 99.075 | 0.925 | 01-02 | 0.875 |

| Dec-16 | 99.010 | 0.990 | 13-14 | 1.000 |

| Jan-17 | 98.970 | 1.030 | 31-01 | |

| Feb-17 | 98.885 | 1.115 | ||

| Mar-17 | 98.850 | 1.150 | 1.125 | |

| Apr-17 | 98.795 | 1.205 | 1.250 | |

| May-17 | 98.730 | 1.270 | ||

| Jun-17 | 98.700 | 1.300 | ||

| Jul-17 | 98.655 | 1.345 | 1.375 | |

| Aug-17 | 98.600 | 1.400 | ||

| Sep-17 | 98.560 | 1.440 | ||

| Oct-17 | 98.520 | 1.480 | 1.5 | |

| Nov-17 | 98.470 | 1.530 | ||

| Dec-17 | 98.430 | 1.570 |

Fed Funds Futures strongly suggest the Fed will move to 1/8 point hikes, down from current moves of 1/4 point or more, and widely spaced at that.

Taking into account FOMC meeting dates, I created the following chart.

Fed Interest Rate Hikes and Dates (Implied from Futures)

Yellen vs. Greenspan

- The above market expectations are clearly similar to Greenspan's famous statement: Hikes will be at a "pace that's likely to be measured".

- The Yellen expected "pace" is half as often.

- The Yellen expected "measure" is half as much.

Measured Pace Revisited

Inquiring minds may wish to investigate my November 6, 2007 commentary on Greenspan's "measured pace", well ahead of the crisis: Greenspan on Housing, Central Bank, Gold .

Even at the above half-pace, half-measure set of market expectations, I suggest we will not see hardly any of those hikes.

Instead, I propose the Fed delayed hikes so long, that an interim recession will gum up the works leaving the Fed no room to cut.

My recession warming still stands.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.